The 7-Minute Rule for Pacific Prime

The 7-Minute Rule for Pacific Prime

Blog Article

Fascination About Pacific Prime

Table of ContentsPacific Prime Fundamentals ExplainedWhat Does Pacific Prime Do?Pacific Prime Fundamentals ExplainedPacific Prime - The FactsPacific Prime Fundamentals Explained

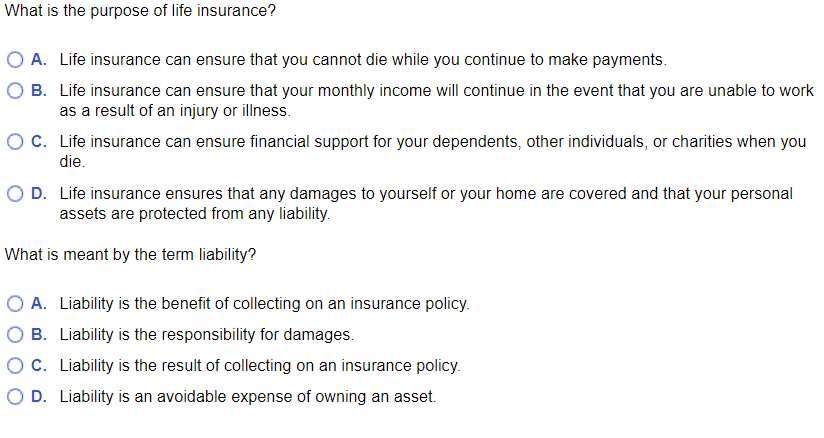

Insurance coverage is a contract, stood for by a plan, in which an insurance policy holder receives economic defense or compensation against losses from an insurance coverage firm. The business swimming pools clients' threats to make repayments much more budget friendly for the insured. Lots of people have some insurance: for their vehicle, their home, their health care, or their life.Insurance additionally helps cover costs linked with liability (lawful obligation) for damages or injury caused to a 3rd party. Insurance policy is a contract (plan) in which an insurance provider compensates another versus losses from specific contingencies or dangers. There are lots of sorts of insurance coverage. Life, wellness, house owners, and automobile are among one of the most common forms of insurance coverage.

Investopedia/ Daniel Fishel Lots of insurance plan types are available, and basically any kind of private or organization can locate an insurance provider ready to insure themfor a rate. Usual personal insurance coverage plan kinds are car, wellness, home owners, and life insurance policy. Most people in the United States contend least one of these kinds of insurance coverage, and automobile insurance coverage is required by state law.

Getting The Pacific Prime To Work

Locating the cost that is best for you needs some legwork. Maximums might be established per duration (e.g., yearly or policy term), per loss or injury, or over the life of the policy, also known as the lifetime maximum.

Policies with high deductibles are normally more economical due to the fact that the high out-of-pocket cost generally causes fewer little claims. There are several kinds of insurance policy. Let's look at one of the most crucial. Health and wellness insurance coverage helps covers regular and emergency situation healthcare expenses, frequently with the choice to include vision and dental services individually.

Lots of preventative services may be covered for cost-free prior to these are fulfilled. Health and wellness insurance may be bought from an insurance coverage company, an insurance policy representative, the federal Health Insurance Industry, supplied by a company, or government Medicare and Medicaid coverage.

The Single Strategy To Use For Pacific Prime

Rather than paying of pocket for car crashes and damage, people pay annual costs to an automobile insurance policy business. The company after that pays all or a lot of the covered costs connected with a vehicle mishap or other automobile damages. If you have a rented automobile or obtained money to acquire a vehicle, your lender or renting dealership will likely need you to lug car insurance.

A life insurance coverage policy assurances that the insurance provider pays an amount of cash to your beneficiaries (such as a spouse or kids) if you die. In exchange, you pay premiums during your life time. There are 2 primary sorts of life insurance. Term life insurance policy covers you for a details period, such as 10 to twenty years.

Permanent life insurance coverage covers your whole life as long as you proceed paying the premiums. Travel insurance policy covers the costs and losses linked with taking a trip, consisting of journey terminations or hold-ups, coverage for emergency healthcare, injuries and emptyings, harmed baggage, rental autos, and rental homes. Even some of the finest traveling insurance companies do not cover cancellations or delays as a result of weather, terrorism, or a pandemic. Insurance coverage is a means to handle your economic risks. When you acquire insurance coverage, you purchase security against unanticipated economic losses. The insurance business pays you or somebody you select if something poor occurs. If you have no insurance and a mishap occurs, you might be accountable for all relevant prices.

The smart Trick of Pacific Prime That Nobody is Discussing

Although there are several insurance plan types, some of one of the most usual are life, wellness, property owners, and auto. The right kind of insurance for you will certainly depend on your objectives and economic circumstance.

Have you ever before had a minute while considering your insurance plan or purchasing for insurance policy when you've thought, "What is insurance policy? And do I truly need it?" You're not the only one. Insurance can be a strange and perplexing point. Exactly how does insurance coverage job? What are the advantages of insurance? And exactly how do you find the very best insurance coverage for you? These prevail inquiries, and luckily, there are some easy-to-understand solutions for them.

No one desires something negative to take place to them. However experiencing a loss without insurance coverage can place you in official site a hard economic circumstance. Insurance is an essential financial tool. It can help you live life with fewer concerns understanding you'll get economic assistance after a disaster or mishap, helping you recuperate faster.

Pacific Prime Fundamentals Explained

And in some cases, like vehicle insurance policy and employees' payment, you may be required by regulation to have insurance in order to safeguard others - global health insurance. Learn regarding ourInsurance choices Insurance policy is essentially an enormous nest egg shared by lots of people (called insurance holders) and handled by an insurance service provider. The insurance coverage firm makes use of money accumulated (called costs) from its insurance policy holders and other financial investments to pay for its operations and to fulfill its assurance to policyholders when they submit a claim

Report this page